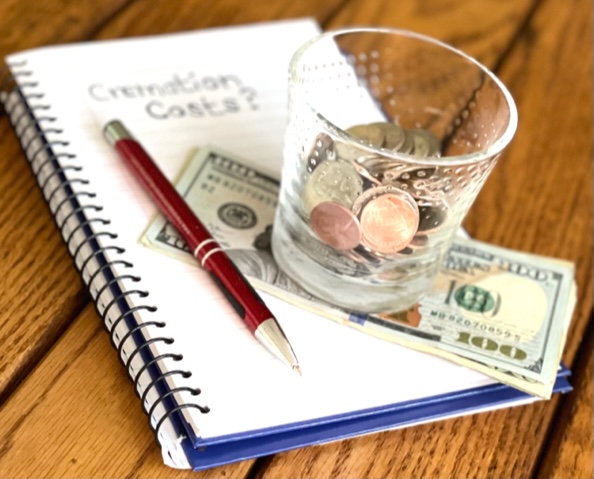

When planning for cremation costs, there are several funding options to consider, including funeral trusts, insurance policies, and Payable on Death (POD) bank accounts. Each has advantages and disadvantages, depending on your needs and financial situation. Here’s a breakdown of each option:

Funding a Cremation Plan with a Funeral Trust

A funeral trust is a contract that sets aside money specifically to pay for funeral and cremation expenses. It is often set up through a funeral home or financial institution.

Benefits of Cremation Plans with a Trust:

Your Money is Protected: The money is earmarked for funeral expenses, ensuring it’s used for its intended purpose.

Tax Benefits: Funeral trusts are often irrevocable, meaning the assets may not count toward Medicaid eligibility if you need long-term care in the future.

Locked-In Prices: Some funeral homes offer pre-need cremation plans with guaranteed pricing, meaning you pay today’s prices regardless of future increases.

Limitations:

Limited Flexibility: Once funds are placed in a funeral trust, they are usually irrevocable, meaning you cannot withdraw the money for other needs.

Funeral Home Restrictions: If tied to a specific funeral home, you may be limited in your choice of providers, which could be an issue if you move or change your mind.

The DFS Memorials network of affordable cremation providers can help you find the best cremation prices near you and connect you with local cremation providers.

Our Cremation Providers all offer simple and affordable cremations. In some areas, direct cremation costs just $795, with the average cost throughout the network around $1,095.

Funding a Cremation Plan with Insurance

Funeral or cremation insurance is a type of life insurance policy specifically designed to cover funeral expenses. It’s often a smaller policy (typically $5,000 to $25,000) with the benefit designated for funeral costs.

Advantages of funeral insurance:

Affordable Premiums: Payments are usually manageable, making it a low-cost way to plan for cremation costs.

Flexibility: Unlike funeral trusts, the funds can be used for any funeral home or cremation provider, and any leftover amount can go to your beneficiaries.

Guaranteed Acceptance: Some policies (like guaranteed-issue life insurance) do not require a medical exam, making it accessible for people with health conditions.

Disadvantages of choosing funeral insurance:

Overall Cost Paid: You may end up paying more in premiums over time than the actual cost of the cremation.

Waiting Periods: Some policies have a waiting period before they fully pay out, so if the policyholder passes away within the first two years, only premiums may be refunded.

Set up a Payable on Death (POD) Bank Account to Cover Cremation Expenses

A Payable on Death (POD) account is a bank account that allows you to name a beneficiary who will receive the funds upon your death. The money remains accessible to you during your lifetime. The money you deposit in your POD account can be immediately accessed by your beneficiary upon presentation of a death certificate and ID and does not need to go through probate.

You can name more than one beneficiary, but it is recommended not to name your funeral director.

Find a Low-Cost Cremation Plan near you ->

Advantages of a P.O.D account to fund a cremation plan:

Easy to Setup: Setting up a POD account is straightforward and can be done at most banks.

Total Control: You retain control over the funds and can withdraw them if needed during your lifetime.

A P.O.D. Avoids Probate: The funds transfer directly to the beneficiary upon death without going through probate.

No Funeral Home Dependency: The funds are not tied to a specific funeral home or cremation provider, so you can choose any. This can be a significant benefit as cremation prices fluctuate, especially as a significant period of time may elapse before you require the funds.

The death care sector, particularly cremation, is experiencing some radical changes and acquisitions right now. Keep your money secure, and choose the right provider when needed.

Disadvantages:

No Price Lock and you need to revise costs allocated over time: The funds may not cover future cremation costs if prices rise, as there’s no guarantee on locking today’s rates. You should, therefore, revise the funds deposited every 6-12 months to ensure the fund remains adequate provision for the services you require.

Temptation to Withdraw Funds: Since you have full access to the funds, it might be tempting to use them for other expenses, leaving less for the intended funeral costs.

So, Which Cremation Plan Funding Option is Best?

Find a Low-Cost Cremation Plan near you ->

Choose a Funeral Trust If…

You want to lock in today’s cremation prices and have peace of mind that the funds will be used solely for funeral expenses. This is ideal if you are concerned about protecting your assets from Medicaid or future creditors.

Choose Funeral or Cremation Insurance If…

You want flexibility in choosing a cremation provider and don’t mind paying premiums over time. Insurance may be a good option if you prefer to spread out payments or leave extra funds for beneficiaries.

Choose a Payable on Death (POD) Account If…

You want full control over the funds and prefer a simple solution without paying insurance premiums. This is a good choice if you’re confident you’ll save enough and want to avoid complex contracts. You can use the DFS Memorials network and website to identify local cremation service prices and allocate funds to your P.O.D.

If you register your POD cremation plan intention with us, we will happily send you an alert if the cremation price for your area changes.

Final thoughts –

Each option has its merits, depending on your financial goals and personal preferences. Funeral trusts offer price guarantees and asset protection, insurance spreads out costs but may be more expensive in the long run, and POD accounts provide flexibility and control but come with the risk of price increases. Assessing your long-term needs, financial situation, and goals is important when deciding which option is best for funding a cremation plan.

Visit our Funeral & Cremation Planning Section for more resources to help you plan a cremation.