Losing a loved one is traumatic enough, but these days, more families are struggling with the dilemma of how to pay for a funeral. If the death was unexpected and no funeral provision had been made, you need to quickly assess your options for paying for a funeral.

Firstly, you need to gain perspective on how to manage the overall costs of a funeral. If you have concerns about how you will pay, keeping costs as low as possible should be a priority.

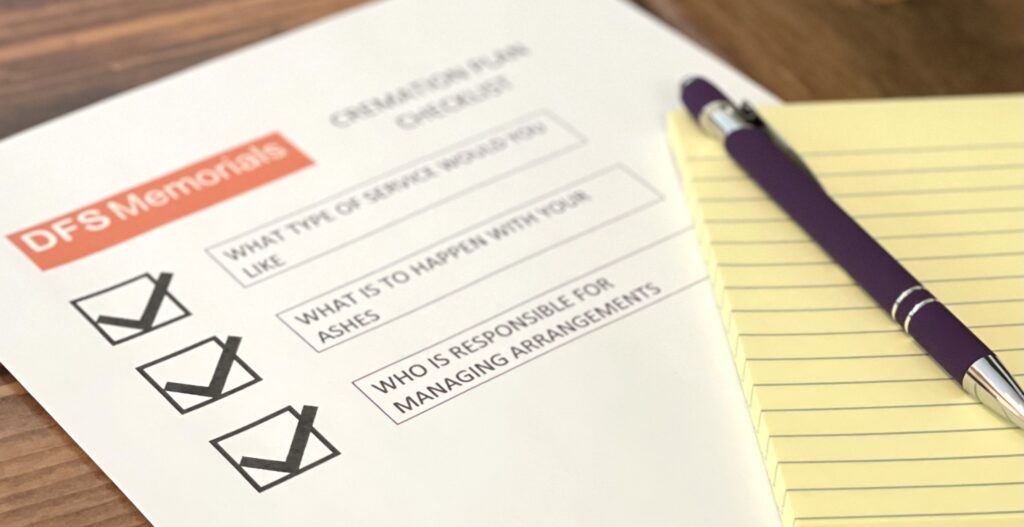

Consider Cremation as a Cheaper Option to Keep Costs Down

Cremation is much cheaper than a burial. You do not need an expensive casket, embalming, or a burial plot. You can still have a dignified service if that is what you wish, or you can have a very simple and minimal-fuss cremation. If, for personal or religious reasons, you require a burial, then you need to keep ancillary services as simple as possible.

However simple your choices are, you will still need a budget to cover your funeral expenses. Various options may help you cover the costs.

A direct cremation service is the lowest-cost cremation disposition option. Direct cremation can be conducted in most cities in the United States for under $1,000. This can be your best way to manage funeral expenses if finances concern you.

All DFS Memorials cremation providers offer a low-cost direct cremation service package. Prices start at $795 in some major metro areas.

Visit our Local Provider Search to find a location and cremation cost near you.

Although credit has historically not been made readily available to customers purchasing funeral products and services, this seems to be changing in our credit-driven culture today. Several credit products are on the market today to assist with meeting funeral expenses.

However, a credit rating level is required, as with any other financing. Some funeral homes now work with funeral financing organizations to help meet their family’s needs. Before entering into any type of credit agreement for funeral finance, be sure that this is the right option for how you choose to manage your funeral payments.

Financing a funeral can be challenging, but several options are available to help cover the expenses. Here are a few ways you can consider to help pay for funeral expenses:

1. Personal savings: If you have savings set aside, you can use them to finance the funeral expenses.

2. Funeral insurance: Consider purchasing funeral or burial insurance specifically designed to cover funeral costs. These policies can provide a lump sum payment to cover the expenses.

3. Prepaid funeral plan: Some funeral homes offer prepaid funeral plans, where you can pay in advance for your funeral services. This allows you to lock in the price and alleviate the financial burden on your loved ones.

4. Crowdfunding: You can create a crowdfunding campaign on platforms like GoFundMe to seek financial assistance from friends, family, and the community.

5. Government assistance: In certain cases, government programs or social security benefits may be available to help cover funeral expenses. Check with your local government or social service agencies for more information. Here is a simple guide to Social Assistance Funeral Programs by State.

6. Personal loans: You may consider taking out a personal loan from a bank or credit union to cover the funeral expenses. Be sure to compare interest rates and terms before making a decision. If possible, avoid getting into debt to pay for funeral costs.

7. Assistance programs: Some charitable organizations, religious groups, or funeral homes offer financial assistance programs to help individuals and families in need.

It’s important to carefully consider your options and choose the one that best fits your financial situation. Additionally, discussing your situation with a funeral director or financial advisor can provide more guidance and support.

You can read in detail about these funeral financing options. What are your options for Paying for a funeral?