Did you know that 80% of Americans (over 18) now travel away from their home on trips that last one night or more? We are a nation that travels. Be this to relocate for education, employment, family, or to enjoy the adventures of traveling.

A Travel Protection Plan for just a one-time enrolment fee of $450 protects you from funeral expenses and stress if a death should occur while you are traveling.

We are all becoming more mobile in our global society. Still, the alarming aspect is that not many of us make suitable provisions for the ‘what ifs’ or the risk of incidents that can occur while traveling.

Health and travel insurance may cover incidental medical expenses, but are you adequately covered should you die away from home and wish to have your remains repatriated? The repatriation of mortal remains can be extremely costly.

Read more to find out how you can protect yourself and provide peace of mind for your family with a one-time payment of $450.

Taking out a Travel Protection Plan is the ideal way to ensure your funeral needs can be met wherever you are without the expense of repatriating remains.

The plan covers the repatriation of the deceased to a local funeral home and funeral or cremation arrangements.

Do you travel away from your primary residence?

If you frequently travel, be it for business or as a retiree, and regularly travel over 75 miles from home, you should consider taking out an inexpensive Travel Protection Plan (TPP).

A travel protection assurance plan will give you peace of mind that should anything happen to you whilst you are away, your plan will cover the repatriation of your remains or funeral services at the place of death.

Are you a retiree or snowbird who winters in another state or country?

Over 50% of international travel is carried out by seniors today. Our baby boomer generation has always been adventurous and has carried this passion into their retirement by embracing the opportunity to travel overseas in their retirement.

Aside from overseas travelers, many retirees choose to winter in the southern states and enjoy a warmer winter climate. This means more seniors are spending considerable time away from their primary residence.

Due to the nature of more affordable medical treatments in some neighboring countries, people are even traveling to obtain medical and surgical procedures not covered by their medical health insurance.

So, whether you travel for pleasure, business, or medical reasons, it is well worth checking your coverage if something happens overseas.

An unexpected death can be very upsetting and overwhelming to deal with. Still, if it should happen whilst you are traveling and away from home and family, it can be even more daunting to try and make the necessary arrangements.

What is a Travel Protection Plan?

The Travel Protection Plan offered through DFS Memorials LLC is a travel assurance policy specifically covering death whilst traveling and the repatriation of mortal remains.

The policy provides either the repatriation of remains from the place of death to a local funeral home or a cremation performed at the place of death. Then, the cremated remains are returned to the family.

It is a simple and inexpensive ‘protection’ policy that covers something many of us do not really want to think about or can find ourselves inadequately covered for.

How does a travel assurance plan cover you?

The Travel Protection Plan is an assurance product. The policy is purchased for a one-time fee of $450. This coverage is inexpensive because although many people will invest in this type of assurance policy, a very small number ever need it, so it can be offered reasonably.

Once you purchase a plan, you receive a unique policy number and a credit-card-sized membership card with contact information.

You should carry this plastic membership when you travel, as it has your policy number and the contact information to activate your policy. It is also advisable to ensure your legal next of kin knows your TPP and has a copy of the details.

What is covered by a travel assurance plan?

The travel assurance plan covers the policyholder in the event of death occurring while traveling. The death must occur 75+ miles from the policyholder’s legal residence in the U.S. or Canada.

It provides an affordable ‘peace of mind’ for the policyholder and family if an unexpected death occurs whilst the policyholder is not residing in their primary residence. All costs associated with repatriating the remains and/or cremation will be handled.

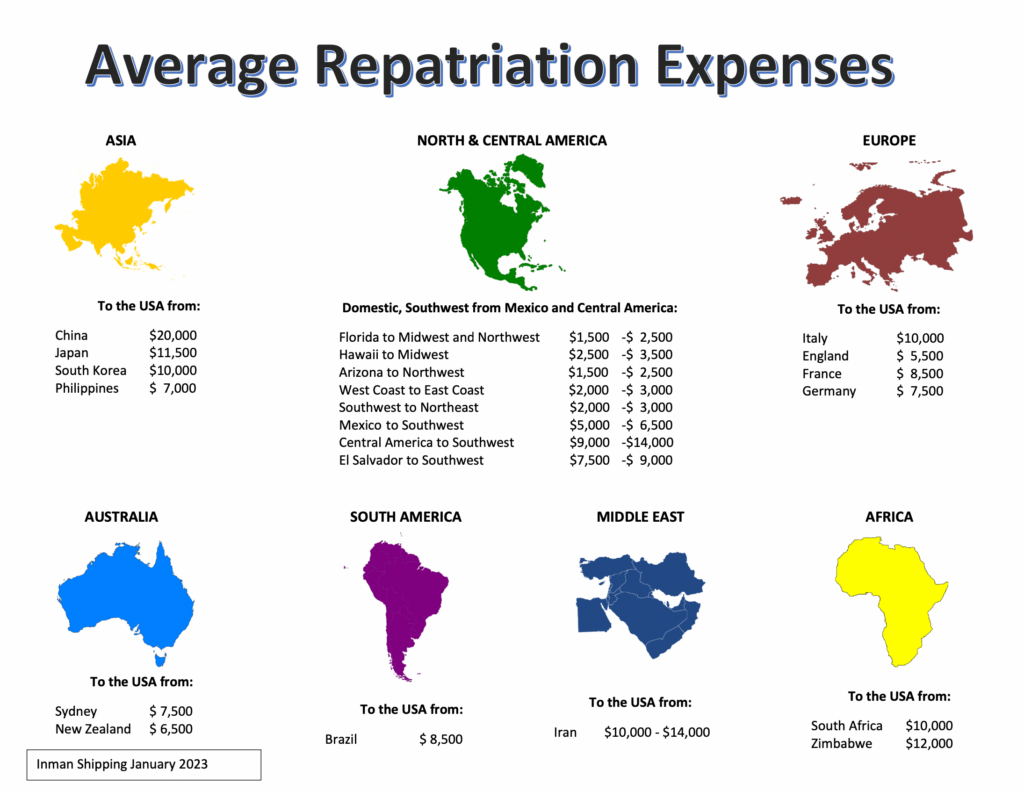

For one low lifetime fee of $450, this policy covers against potential repatriation of remains costs reaching $10,000 – $20,000.

How would I benefit from purchasing a Travel Protection Plan?

As mentioned above, if you travel frequently or spend considerable time away from your main residence, you will benefit from the ‘peace of mind’ this policy will give you and your family.

Repatriation of mortal remains is much more expensive than people realize. Returning mortal remains domestically can cost upwards of $3,600, and international repatriation of remains can cost as much as $20,000.

This simple Travel Protection Plan at the low cost of $450 could save your family thousands on the cost of returning your remains home.

Even if the family opts for a cremation at the time of death, this can still amount to a few thousand dollars.

You also have the support of a team of dedicated staff familiar with the complicated legal aspects of transporting mortal remains and/or planning arrangements with funeral homes in another state or country.

Many travel or medical insurance plans will provide coverage for repatriation for medivac in the event of a medical emergency overseas. Still, repatriation coverage for mortal remains is often an ‘add-on’ aspect at an additional cost.

How much can I save by ensuring I have a Travel Protection Plan?

You can save thousands of dollars. For a one-time payment of $450, you give your family protection for your lifetime if something unforeseen or tragic happens while you are traveling or spending time away from home. A couple’s plan is available for a fee of $875.

How do I purchase the Travel Protection Plan?

Anyone of any age can apply for a Travel Protection Plan. Visit our dedicated DFS Memorials Travel Protection Plan—Enroll Now.

Your plan will be issued once you complete the online enrollment and submit your one-time payment. There are no further payments. Full documentation is mailed to you within seven days.

If you have further questions before purchasing this Peace of Mind Plan, visit our Frequently Asked Questions page or call us today.

Average Repatriation or Funeral Shipping Costs